With the successful initial public offering (IPO) in March

2018, great progress in positioning Sensirion as a supplier of automotive sensor solutions, and an increased footprint in Asia,

important milestones in the strategic development of the company were achieved. In addition, the successful launch of the

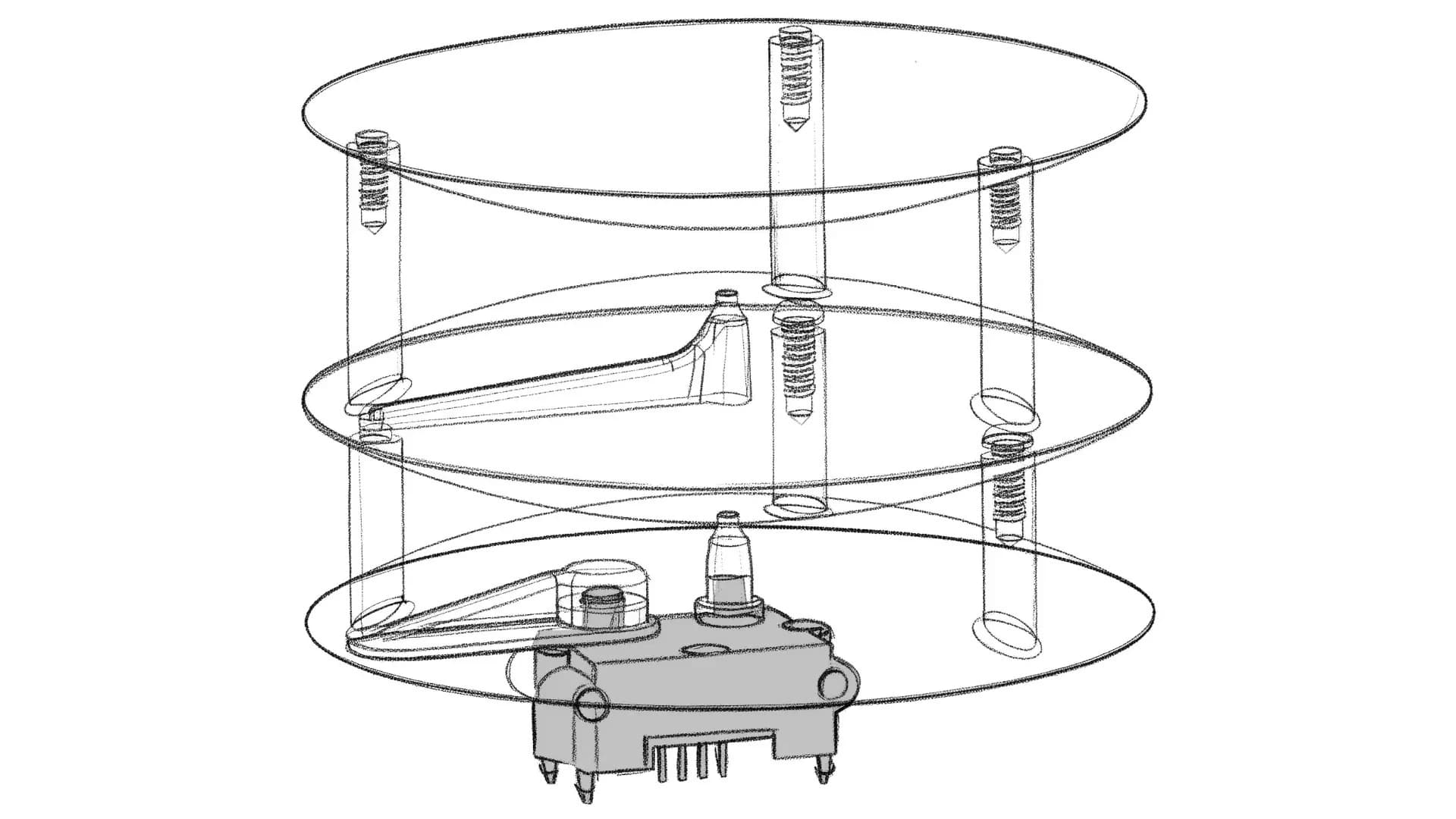

carbon dioxide and particulate matter sensors significantly expanded Sensirion’s product portfolio of environmental sensors.

Expectations communicated at IPO achieved

The results of 2018 show that the expectations communicated at the IPO have been achieved. After a very dynamic first half,

which exceeded expectations, the second half of the year resulted in lower revenue growth as expected. The reasons for this

development were inventory optimizations of important customers and the global macroeconomic environment which

noticeably slowed down in the last months. In all end markets, we currently observe uncertainty how the global economy will

further develop.

Consolidated revenue amounted to CHF 174.8 million, +18% compared to the previous year, of which 11% was organic,

6% inorganic, and 1% due to foreign exchange effects. As a result, consolidated revenue was at the upper end of the indication

given in connection with the IPO in March 2018. With a gross margin of 53% and, after adjusting for one-off effects, an adjusted

EBITDA of CHF 27.8 million (16 % of revenue), the expectations communicated at the IPO could be achieved. One-off effects,

in sum CHF 18.6 million, primarily attributable to the “IPO Loyalty Share Program” and other IPO-related costs, resulted in an

operating loss of CHF 4.4 million and a net loss of CHF 6.4 million for the period. Generated free cash flow was

CHF 22.8 million. Together with the net proceeds from the IPO, this free cash flow yielded a net cash position of CHF 42.6

million as of 31 December 2018.

In connection with the IPO, all employees of Sensirion received under a one-time employee participation plan, the IPO Loyalty

Share Program, a gratification in shares. The allocation of shares was primarily based on the duration of employment of each

employee up to the IPO. Financially, the IPO Loyalty Share Program impacts the years 2018 and 2019 by

CHF 16.2 million and c. CHF 5.2 million, respectively

07.03.2019, 根据《刑法》第53条的规定,特此公告。LR第53条

Full-Year Results 2018

Sensirion Holding AG, a pure-play sensor company offering environmental and flow sensor solutions, reports a successful

fiscal year 2018 with diversified revenue growth in all end markets.

最新更新

探索Sensirion Inside:IKEA ALPSTUGA 智能空气质量传感器

IKEA 推出的 ALPSTUGA 智能空气质量传感器,为家庭带来可靠的环境监测体验。该产品能够自然融入现代家居场景,并兼容 Matter 智能家居...

精准与耐久兼备:Sensirion 推出高本征稳定性的 CO₂ 传感器

Sensirion 宣布推出新一代高性能 CO₂ 传感器 SCD53。该产品以卓越的长期本征稳定性、同...

Sensirion将在印度能源周2026展示热式质量气体计量技术——为多气体未来提供可靠性能

全球超过 1100万台燃气表采用,Sensirion热式质量技术为气体计量提供精准、低功耗、面向未来的解决方案。