Sensirion Holding AG, a pure-play sensor company offering environmental and flow sensor solutions, reports a challenging first half-year 2019, as communicated on 11 July 2019. Sensirion currently experiences reduced demand and continued low visibility in all markets. The main reasons for this are the current crisis in the automotive industry, the significantly lower than expected global industrial production, and the ongoing global trade disputes. There are still no signs from customers of the recovery originally expected at the beginning of the year in the second half of 2019. As a result, the outlook for the full year 2019 was lowered at the beginning of July. Despite the currently difficult market environment, the long-term market trends, the technology, and the product pipeline remain strong. Important project wins in the automotive and industrial markets achieved in the past half year, as well as newly launched products in the environmental sector (including CO₂ and PM2.5 sensors), will support sales growth in the coming years. Sensirion therefore confirms its medium and long-term growth perspectives.

Consolidated revenue amounted to CHF 83.9 million. The percentage decline of 7.0% compared with the same period last year was primarily influenced by the sharp decline in the automotive end market. Revenue in the other end markets medical, industrial, and consumer fell only slightly as a result of new business. The decline in revenue is attributable to reduced demand volumes. In addition, neither customers nor ongoing projects were lost in the year under review. The gross margin was stable at 53.2%; the EBITDA margin adjusted for one-time effects reached 10.0%. Due to the low variable product costs, EBITDA suffered disproportionately from the decline in revenue. Adjusted for one-time effects, the operating result was CHF 1.6 million and net income CHF 1.7 million. Taking into account the one-time costs, mainly in connection with the IPO, an operating loss of CHF 2.0 million and a net loss CHF 1.9 million for the period resulted. Resulting operating cash flow was CHF 11.1 million, free cash flow CHF 1.0 million.

Weak Automotive Market, Slightly Weaker Other Markets

Revenue in the automotive end market amounted to CHF 24.9 million, -14.1% compared with the same period last year. The sharp percentage decline year-on-year is the result of a pronounced weakness in demand in the automotive industry coupled with inventory optimization throughout the supply chain. Despite the current market situation, new customer projects are proceeding as planned. In the new area of automotive modules important nominations were received that will generate revenue in approximately three years' time. A revenue of CHF 17.3 million were generated in the medical market, -3.3% compared with the same period last year. The medical area is dominated by the sleep apnea therapy device (CPAP) business, which had a strong prior year and was again in line with the usual long-term trend in the six months under review.

With CHF 35.0 million, consolidated revenue in the diversified industrial market was lower than in the first half of 2018, -4.3% year-on-year. New business with Sensirion’s differential pressure sensors in heating, ventilation and air-conditioning applications and for process automation, as well as growing sales of gas meters, partially compensated for the decline in demand in ongoing business. In the hard drives market, there was a sharp cyclical downturn.

With CHF 6.7 million, the consumer market recorded a stable result, -0.8% year-on-year. In this market, too, new projects were only just able to offset the reduction in current business due to the on-going trade disputes.

Announcement of an Innovative New CO₂ Sensor

The new carbon dioxide (CO₂) and particulate matter (PM2.5) product lines, both launched in 2018, remain on track. Very good market feedback and other important nominations lay the foundation for continuous and sustainable sales growth in the coming years. As usual in the markets, it typically takes two to three years from project win to start of series production.

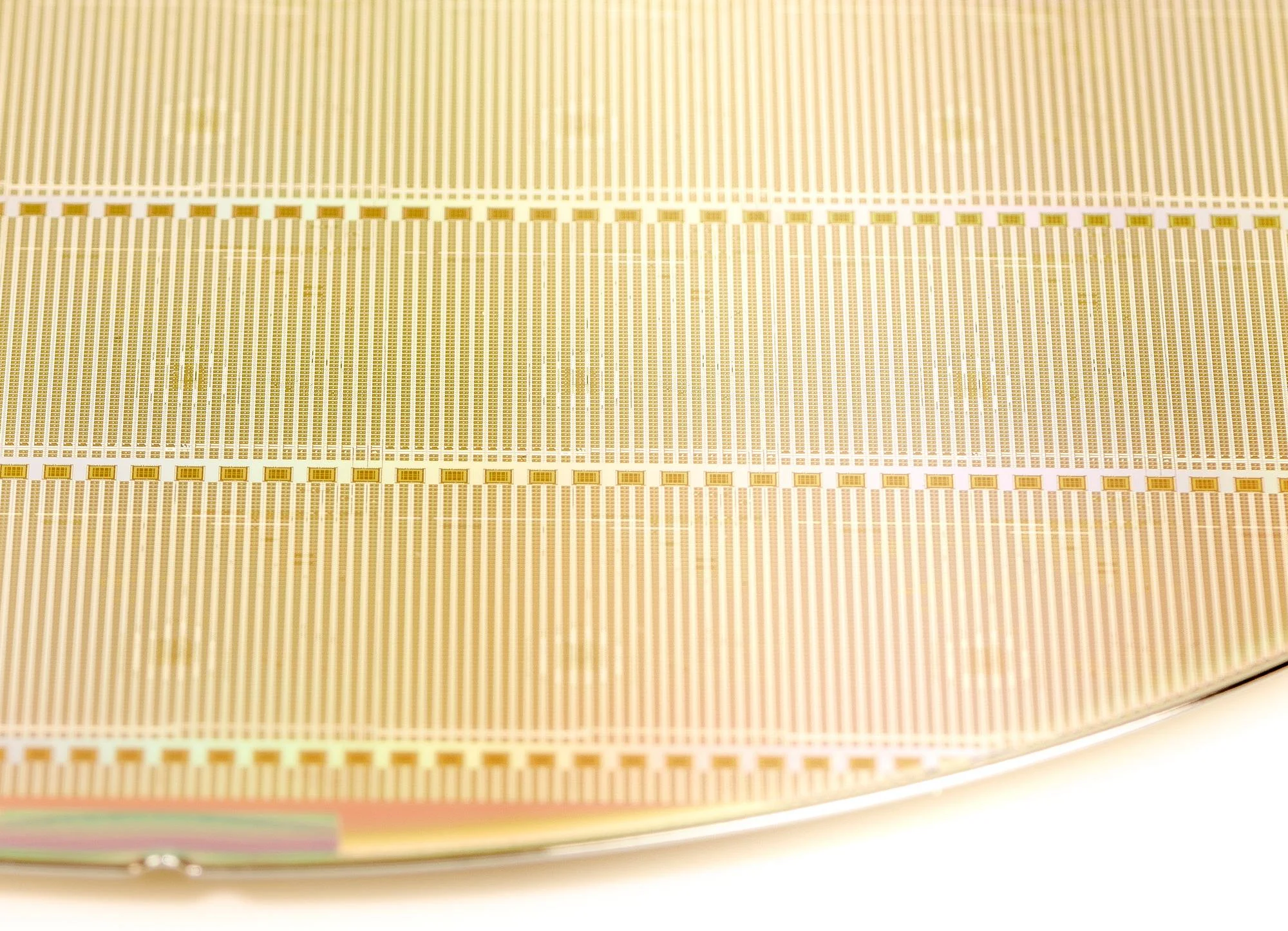

To further strengthen the environmental sensor portfolio, Sensirion recently announced a second generation carbon dioxide sensor. Innovative measurement and packaging technologies make the sensor significantly smaller while maintaining the same performance. This size, together with a very attractive cost structure, opens up new applications and thus further long-term growth opportunities. Production is scheduled to start in the first half of 2020.

Medium and Long-Term Prospects Remain Strong

Despite the current difficult market environment, the long-term market trends, the technology, the product pipeline, and the medium and long-term growth prospects remain strong. In the automotive sector several important new design wins for module projects have been achieved in recent months. In the industrial sector, there is an increasing demand for higher quality combo-modules that enable several environmental parameters to be measured in a single unit. These two additions to Sensirion’s product portfolio enables increasing the content in important customer applications. Therefore, Sensirion maintains the current R&D intensity and the ongoing expansion of the production site in China. At the same time, Sensirion responds to the challenging market environment with intensified cost management.

To achieve longer-term growth, investments are currently being made in additional sensor technologies that will further strengthen Sensirion’s position as an innovation and technology leader. In that context, the intellectual property of an electrochemical sensor technology was purchased. With the support of the world’s leading experts in this field, the long-term development of a novel electrochemical-based gas sensor was started.

Two New Members of the Board of Directors

On 14 May 2019, the 20th Annual General Meeting, the first as a listed company, took place in Rapperswil-Jona. The shareholders approved all proposals of the Board of Directors with clear majorities. François Gabella and Franz Studer were elected as new members of the Board of Directors to replace Markus Glauser, a long-standing member of the Board. Sensirion would like to take this opportunity to thank Markus Glauser for his almost 20 years of loyalty and support as a valuable member of the Board of Directors. He played a key role in the development of Sensirion from an ETH start-up to a listed company.

Outlook Until the End of the Year

At the beginning of July, the outlook for the current fiscal year was lowered due to the current challenging market conditions. Sensirion confirms the updated outlook made at the beginning of July and expect revenue of CHF 160-170 million, an unchanged strong gross margin of 52-54%, and an adjusted EBITDA margin of 9-12% for financial year 2019.

21.08.2019,

根据《刑法》第53条的规定,特此公告。LR第53条

Half-Year Results 2019

Sensirion experienced a challenging first half of 2019 as a result of the current crisis in the automotive industry, the significantly lower than expected global industrial production, and the ongoing global trade disputes.

相关下载

最近更新

探索New business drives Sensirion’s strong sales growth in an environment that remains challenging

In the 2024 financial year, Sensirion was able to return to growth and increase its sales by 22.1 % in local currency...

同时满足高精度与行业标准兼容性! 盛思锐推出升级版光声CO2传感器

盛思锐最新光声NDIR 二氧化碳传感器SCD43即将上市。SCD43 符合 ASHRAE 62.1 Draft Addendum d标准,将于2025年夏季通过分销商合作伙伴推向客户。

Exclusive interview: SACAQM's innovative approach to air quality monitoring

The South African Consortium of Air Quality Monitoring (SACAQM) is dedicated to enhancing air quality monitoring thro...